If you’re not a fan of manual entry, or you’d like to bring in missing expenses, or older expenses than the ones brought in by your bank connection, you can upload expenses in bulk with a CSV file in the same currency.

Most banks will allow you to download your transactions as a CSV file. We recommend making a separate CSV file, ensuring the file has these required headers, and then filling it in with your data:

| Amount | Category | Date | Description | Merchant |

-

Amount

- Use the same currency format for all numbers (123,456.00, 123 456.00, or 123.456,00)

- Use all negative (-x.xx) or all positive numbers only, mixed numbers will result only in negative numbers (-x.xx) being imported in

-

Category - Use only Operating Expense parent categories or subcategories

- If the category does not yet exist, expenses imported under this non-existent category will be categorized under Uncategorized Expenses instead

- Date - Use the same date format for all (month, day, year; day, month, year; or year, month, day)

- Description

- Merchant

Once your file is ready, import it in with these steps:

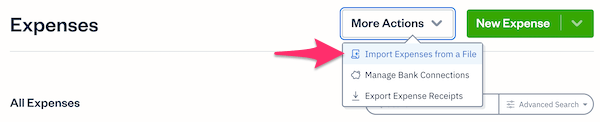

- Select the Expenses section

- Then select the More Actions button

- Next, select Import Expenses from a File

![Import expenses from a file button in Expenses section.]()

- Select Choose File…

- Then select your CSV

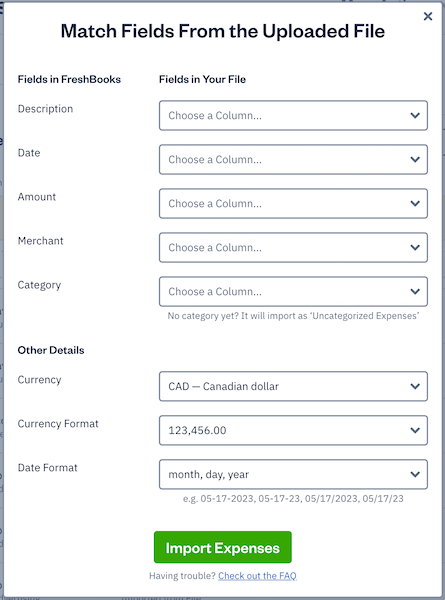

- Match the fields to the columns from your file using the dropdown (e.g., Date should match to the column in your file that is also labelled as Date)

![Fields for mapping from your file to the fields in Freshbooks.]()

- Once you’re done matching, under Other Details, specify your Currency

- Next, for Currency Format, choose either 123,456.00, 123 456.00, or 123.456,00

- Then for Date Format, choose either month, day, year; day, month, year; or year, month, day

- Select Import Expenses. New expenses will be added and you can start reviewing them in your list of expenses.

Notes:

- If the file import was not successful, check below for common reasons

- You can edit any expenses, including adding sales taxes, in the Expense section after uploading the file

FAQs

How are duplicate expenses handled?

All expenses will be imported in, regardless if they are duplicates or transfers to pay off a balance. We recommend checking the CSV before import to ensure only unique transactions are brought in.

Which types of transactions can be imported in?

Only negative amounts as -x.xx (withdrawals, payments, or debits) can be imported in. If your file has both positive and negative amounts, the negative amounts will only come in.

If your file only has all positives or all negatives, they will still be imported in. If you've accidentally imported in credits or reimbursements, you can delete the expenses afterwards to keep your reporting accurate.

If your file only has all positives or all negatives, they will still be imported in. If you've accidentally imported in credits or reimbursements, you can delete the expenses afterwards to keep your reporting accurate.

If you're looking to import all types of transactions in, review How do I add, edit, or delete manual transactions in bank reconciliation? instead.

Why did I get an error uploading my file?

The CSV file may be invalid depending on the error:

- The CSV file itself is corrupt - Copy the information to a new workbook and re-save as a .csv format

- There are no header columns in the file or one header column is missing - Amount, Category, Date, Description and Merchant are required to be the first row in the file (if headers are missing, the first row is skipped)

- There are unsupported characters like $ in the Amount column

- The dates under the Date column are not written with dashes (-) or slashes (/) in between numbers (e.g., 01/17/2020 and 01-17-2020 are accepted)

- The specified date format does not match the format in the file

- The file contains multiple sheet tabs - Separate multiple sheet tabs into separate CSV files instead

- The file is larger than 5 MB - Try splitting it into two or more CSVs instead