Bank Reconciliation (Bank Rec) allows you to match any bank transactions to any FreshBooks Entries in your account so that your book balance matches your account balances. It also allows you to create transfers, owner’s equity, and expense refund transactions by marking your bank transactions as such.

Bank Reconciliation requires a bank connection so that you can match transactions from your bank statement to your activity inside FreshBooks. First, you’ll connect to your bank account, then you’ll set an opening balance before you can reconcile transactions.

Bank Reconciliation requires a bank connection so that you can match transactions from your bank statement to your activity inside FreshBooks. First, you’ll connect to your bank account, then you’ll set an opening balance before you can reconcile transactions.

Set Up Bank Connection

Set up a bank account to start importing transactions from a bank connection:

- Select the Accounting section

- Then select the Connect My Bank inside the Bank Reconciliation widget

- Next, set up the bank connection with the steps in How can I import expenses from my bank account? here

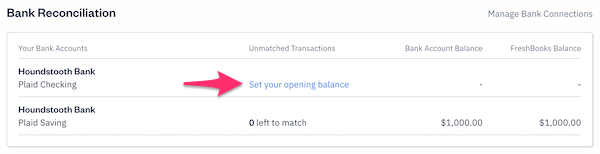

- Once connected, or if you’ve already connected any bank accounts previously, they’ll appear here, and you’ll find a Set your opening balance link.

Notes:

- Crypto, investment, loan and line of credit accounts will not be imported for bank reconciliation - your accountant can manage these as journal entries instead

- Only connect your business bank account and not your personal bank accounts

- You can only reconcile in a single currency, transactions from FreshBooks will only appear if the currency is the same as your connected bank account

- Manual journal entries will affect the account’s FreshBooks balance but will not appear under FreshBooks Entries section to reconcile

Set an Opening Balance

Once you have a bank account (or several) connected, you’re ready to set the opening balance which will determine the amount you’ll start reconciling with moving forward. Your invited accountant can also help you with this set up:

- Select the Accounting section

- You’ll now find your bank account(s) listed in the Bank Reconciliation widget, select the Set your opening balance link

![Set opening balance link inside Bank Rec widget.]()

- In the field provided, enter a date to start reconciling from (we recommend the first day of a recent bank statement or the start of a period on your credit card statement)

- Select Continue

- Enter your Opening Balance from the day you chose to start reconciling in the field

- If you’re setting up a credit card account, this is your Previous Statement Balance (if you’ve paid off your credit card balance, this would be $0)

- Or jump down to the Find Your Reconciliation Start Date and Opening Balance section if you need detailed steps

- Choose the Currency of your bank account you’re reconciling

- Then select Continue again

- You’re now ready to start reconciling this account. Select Get Started to begin.

Note:

- The Bank Account Balance and FreshBooks Balance will show a positive balance for bank accounts while credit card accounts will show a negative balance instead - this is due to credit cards being considered as a liability in the Chart of Accounts

- The Bank and/or Credit Card account and opening balance will be automatically created in your Chart of Accounts

- Bank accounts will be added under Cash, the parent account

- Credit Card accounts will be added under Credit Cards, the parent account

At the top right of your bank reconciliation, you'll find two balances which represent different amounts:

- Bank Account Balance - This includes your opening balance entered for this account, and all imported transactions in real-time (as of the most recent sync)

- FreshBooks Balance - This is your opening balance entered for this account, +/- the transactions you have matched in bank rec, as well as any journal entries that have been posted to this account

Find Your Reconciliation Start Date and Opening Balance

While you're setting up bank reconciliation, if you're having trouble finding your reconciliation and start date, use the below steps depending on whether you're looking at a Bank account or Credit Card statement. Note that you can edit your opening balance again anytime:

For Bank Accounts

Most bank account statements include a running balance or amount column that shows the total of the bank account after a particular transaction. Use this balance or amount column to find your Reconciliation Start Date and Opening Balance for bank rec with these steps:

- View or download the bank account statement for the period that you want to reconcile in

- Using the statement, determine whether you want to start reconciling from the first day on your statement or in the middle of your statement period:

-

For the first day of your statement:

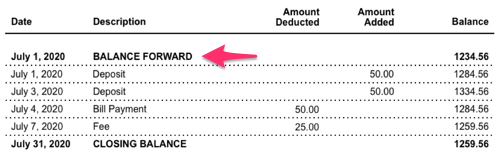

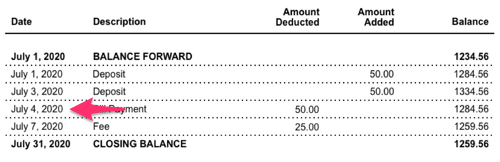

- On the statement, find the Opening Balance or Balance Forward line at the top of your list of transactions

![A sample bank account statement with the Balance Forward line selected.]()

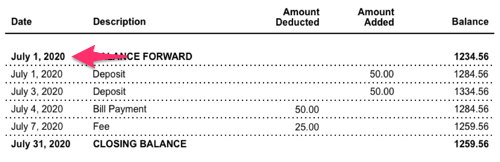

- Enter the Date of your opening balance/balance forward line into FreshBooks’ Bank Rec as your Reconciliation Start Date

![A sample bank account statement with July 1, 2020 selected next to the Balance Forward line.]()

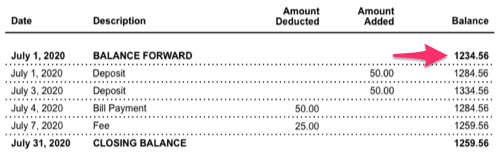

- Then enter the Balance or Amount of your opening balance/balance forward into FreshBooks’ Bank Rec as your Opening Balance

![A sample bank account statement with the amount next to Balance Forward selected.]()

- On the statement, find the Opening Balance or Balance Forward line at the top of your list of transactions

-

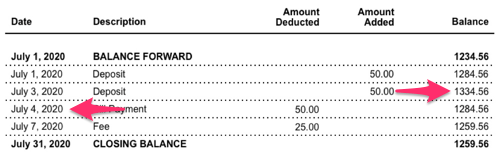

For a date in the middle of your statement:

- On the statement, find a Date next to any transaction you want to start reconciling from and put this into FreshBooks’ Bank Rec as your Reconciliation Start Date

![A sample bank account statement with July 4, 2020 selected in a list of transactions.]()

- Then on the statement, find the Balance or Amount one day before the date you chose (e.g., if you chose July 4, look for the balance next to July 3 instead (or the next row above it if the next available transaction is older than July 3)

![A sample bank account statement with the amount selected from a transaction dated July 3, 2020 before.]()

- Enter this Balance or Amount from the day before into FreshBooks’ Bank Rec as your Opening Balance. This ensures that only transactions from your reconciliation start date are imported in for you to reconcile, which is why they should not be included in the opening balance amount.

- On the statement, find a Date next to any transaction you want to start reconciling from and put this into FreshBooks’ Bank Rec as your Reconciliation Start Date

-

For the first day of your statement:

Note: If the balance is a positive number (e.g., xx.xx), or it is a negative number (e.g., -xx.xx or (xx.xx)), it should be entered the same way in your Opening Balance (meaning the opening balance should be positive for positive balances and the opening balance should be negative for negative balances).

The opening balance you’ve entered will create a journal entry that affects the Bank (Cash) and Opening Balance Adjustments (Equity) accounts. Review Chart of Accounts for more details.

For Credit Card Accounts

Most credit card statements include an amount column that shows after a particular transaction. Use this Balance/Amount column to find your Reconciliation Start Date and Opening Balance for bank rec with these steps:

- View or download the credit card statement for the period that you want to reconcile in

- Using the statement, determine whether you want to start reconciling from the first day on your statement or in the middle of your statement period (starting from the first day of your statement is highly recommended):

-

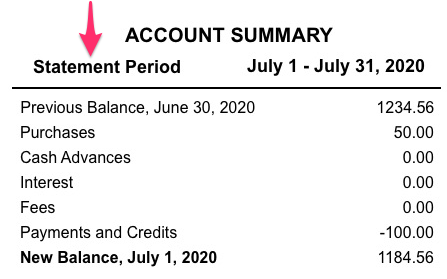

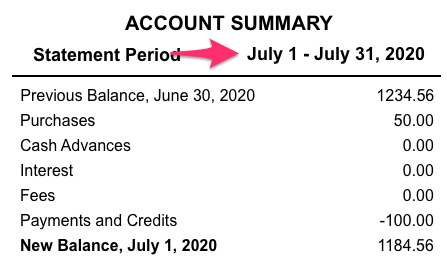

For the first day of your statement:

- On the statement, find the Period Covered by Statement, Statement Period, or Opening Date

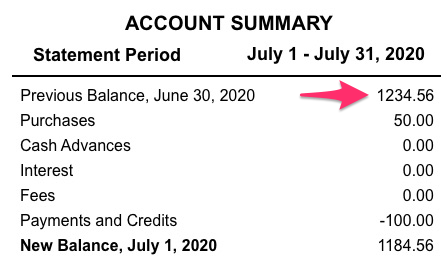

![A sample credit card account statement with statement period indicated.]()

- Put the opening Date into FreshBooks' Bank Rec as your Reconciliation Start Date (e.g., if the statement period is July 1 to July 31, put in July 1)

![A sample credit card account statement with the date in a statement period indicated.]()

- Then put the Previous Balance into FreshBooks’ Bank Rec as your Opening Balance. This ensures that only transactions are imported into bank rec from the date you specified moving forward

![A sample credit card account statement with the amount next to previous balance selected.]()

- On the statement, find the Period Covered by Statement, Statement Period, or Opening Date

-

For a date in the middle of your statement (please follow the steps below carefully):

- Choose any date within the statement period and put this into FreshBooks’ Bank Rec as your Reconciliation Start Date (e.g., July 28)

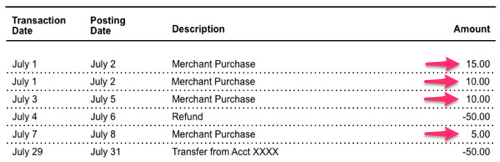

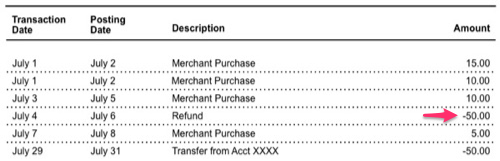

- On the statement, find the Previous Balance and use this as your starting amount to calculate from (e.g., 1234.56)

![A sample credit card account statement the amount next to previous balance selected.]()

- Next, add up any purchases, interest charges and fees that were posted before your Reconciliation Start Date to the Previous Balance amount

![A sample credit card account statement with purchase, interest charge and fee transactions selected.]()

- Then subtract any payments and credits that were posted before your Reconciliation Start Date to Previous Balance amount

![A sample credit card account statement with payment and credit transactions selected.]()

- Double-check your calculated amount, and ensure you have not added or subtracted amounts that are posted on the Reconciliation Start Date as they will be included afterwards when you start your Bank Rec

- Put the new amount you’ve calculated into FreshBooks’ Bank Rec as your Opening Balance. If it’s an outstanding amount, enter this as a positive number, or if it’s an overpaid amount, enter this as a negative number.

-

For the first day of your statement:

The opening balance you’ve entered will create a journal entry that affects the Credit Card (Liability) and Opening Balance Adjustments (Equity) accounts. Review Chart of Accounts for more details.

FAQs

My Opening Balance is incorrect or not far back enough, how do I fix this?

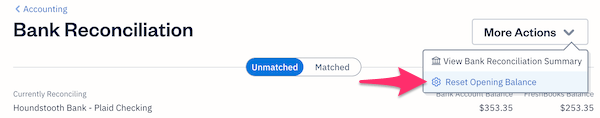

If you've set the wrong Opening Balance or you need to change it to look further back especially after importing older transactions, you can reset your opening balance with these steps:

- Select the Accounting section

- Then select the # left to match link for the account you want to fix the opening balance for

- Next, select the More Actions button

- Select Reset Opening Balance

![Reset opening balance button under More Actions.]()

- Choose a new Reconciliation Start Date

- Then enter in the new Account Balance as of Start Date

- Select Continue

- Confirm the details and select Reset to finish

- You can now match up transactions with the new opening balance, including any older imported transactions from the new date.

What happens if I reset my Opening Balance?

If the Opening Balance that you set in your bank account is incorrect, you can reset it to the new correct amount. If only the balance is changed, previously matched transactions will remain.

If the date is changed to either:

If the date is changed to either:

- A date in the future - Only matched transactions between the old date and the new date will be unmatched to ensure they are not double-counted

- A date in the past - Nothing is unmatched

Your FreshBooks Balance will now update to reflect the new opening balance.

How do I disconnect my bank account to stop importing transactions?

Look for your supported country here and follow the steps outlined in your bank connection partner's article.

How do I clear a disconnected bank account?

Clearing a disconnected bank account allows you to zero out the account in your chart of accounts. Note that clearing a disconnected bank account will:

- Unmatch all previously matched transactions in Bank Rec for this account - this affects Petty Cash and either the Bank account (Cash) or Credit Card account on the Chart of Accounts (CoA), Petty Cash will list all unmatched transactions instead

- Erase the Opening Balance - The amounts will be removed next to Opening Balance Adjustments and the Cash or Credit Card accounts in the CoA

- Expenses previously imported by the disconnected account will still remain inside FreshBooks

- The Bank account or Credit Card account on the CoA remains with a $0 balance instead

Steps to Clear Disconnected Account:

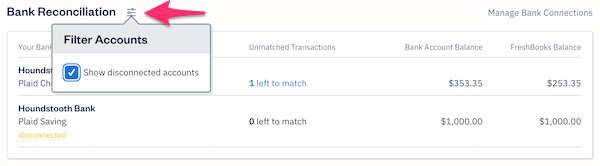

- Select the Accounting section

- In the Bank Reconciliation widget, if you have your disconnected accounts hidden, select the filter next to Bank Reconciliation

- Then check off the checkbox next to Show disconnected accounts

![Checkbox to show disconnected accounts in bank rec widget.]()

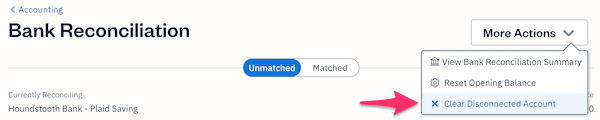

- Select the # left to match link next to the disconnected account

- Then in the top right, select the More Actions button

- Select Clear Disconnected Account

![Clear disconnected account option in dropdown.]()

- Select Continue and then select Clear Account to finish. This disconnected bank account should now display a Set your opening balance link instead of # left to match link.