Complete setting up your WePay account by verifying your business and payment details. Once this is complete, you can start accepting online payments using WePay.

Verify your WePay Account

If you haven't already, get started by setting up WePay first. Or if you selected Not Now when enabling WePay, you can use the same steps below to finish your setup:

- Go directly to Online Payments here, or select the Settings section

- Under Connections and Integrations, select Online Payments

- Then to continue setting up your WePay account, select either:

- In your inbox, find an email from FreshBooks via WePay and select the Select to Verify and Continue Setup button in the email

- Or if you can’t find the email, select the Verify Now next to Verify Your Business in your FreshBooks account to resend it

- On the Set your Secure Payments Password window, enter a new Password for your WePay account

- Then select Continue

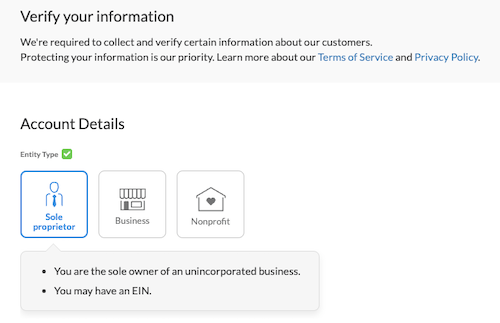

- On the Verify your Information window, under Entity Type, choose between Sole Proprietor, Business, or Nonprofit

![WePayEntityType.png]()

- If Business is selected, choose between Corporation, LLC, or Partnership

- Then enter your Business / Nonprofit details and your Personal / Controller details

- Select Submit

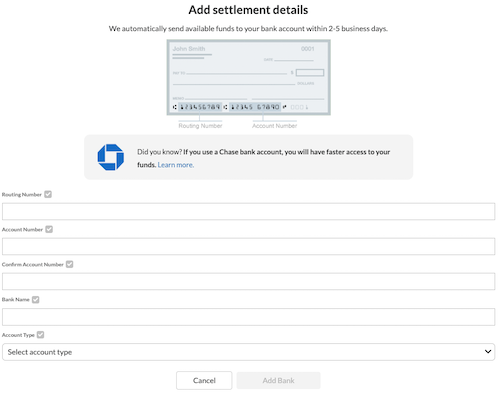

- Next, on the Add settlement details window, add your details:

![Add settlement details window with bank information to fill out.]()

- For US accounts, add your Routing Number

- For Canadian accounts, add your Transit Number and Institution Number

- Then add your Account Number and Bank Name

- For Account Type, choose between Checking or Savings

- Next, select Add Bank

- You’ll be taken back to your Online Payments settings, which will reflect your connected WePay account. Access your WePay account anytime with the steps in How do I manage my online payments settings? here.

Business Types

- Business – Choose this if you’ve filed official government paperwork, such as articles of incorporation, or if you are an Individual

- Nonprofit Organization - Choose this if you’ve filed official government paperwork, like your status as a Registered Charity

- Sole Proprietor – Use this if you have a corporation number and wish to use it for tax reporting purposes, or if you are an Individual

Account Verification

The KYC (Know Your Customer) form is the process through which WePay verifies your account with the below (or review the full list of verification documents here):

- Details about your business

- SSN (Social Security Number for US users) or,

- SIN (Social Insurance Number for Canadian users)

- EIN (Employee Identification Number) for tax reporting on behalf of a corporation or organization (required for Business, Nonprofit Organization and Sole Proprietor accounts)

- US or Canadian bank account information

This is facilitated by WePay's Trust Center to verify your identity and your customers, as well as comply with anti-money laundering laws. It is also required for any tax reporting depending on your business type. This a required step in order to receive your payments.

After you have received a payment, you have 90 days to verify your account through the KYC process. If you don’t verify your account in time, any payment that you've received will be refunded to your client and any further payments will not go through until verification is done.

If any of the information above is incorrect, WePay will send you an email with a link asking you to update your account information.

Additional Verification

Occasionally WePay may request additional documentation to verify your business by email at any time during your use of WePay. Like with Account Verification (KYC), this is done to ensure each transaction is safe and secure.

Once you've responded to WePay's email with the requested documentation, it can take some time for the verification process to be completed. WePay may also follow up with a request for more documentation or clarification - it is important you respond to these emails so that the process can be completed as quickly as possible.

Note that any payments processed during this time may be paused until verification is complete.