Payments processed by WePay can take an average of 1-3 business days to process for credit cards, and up to 5 business days for bank transfers, before sending to your bank account. Your first transaction and any manually reviewed payment takes approximately 5-7 business days to complete instead.

The breakdown of those days for all payments are as follows:

- The payment is processed by WePay instantly, then:

- If approved, the payment is deposited into your WePay account (this takes up to 5 business days for bank transfers)

- If not approved, the Processing status remains on your invoice while the payment is in manual review by WePay's Trust and Safety team (especially if it's your first transaction or an unusually larger transaction), which takes an extra 1-3 business days (review section 12 here), then:

![Processing banner above an Invoice.]()

- If manually approved, the payment is deposited into your WePay account

- If not manually approved, the invoice is updated to reflect a Declined status

- Once funds are in your WePay account, any available amount is sent to your bank account as a payout (dependent on your payout frequency). This takes an extra 1-3 days, depending on which bank or financial Institution you're with.

If the payment immediately declines, have your client try again. Ensure all payment details are entered correctly and the client's web browser is up to date.

Chase Bank Accounts

If your WePay account is connected to a Chase bank account:

- All transactions received and approved up to 5 pm PST will be in your bank account that night (e.g., approved by Monday at 5 pm PST will appear in your account the same day on Monday night)

- Any transactions accepted and approved after the 5 pm PST cutoff time will be included in the next day’s deposit instead

Other Bank Accounts

If your WePay account is connected to a non-Chase bank account:

- All transactions received and approved up to 5 pm PST will be deposited into your bank account the following day (e.g., approved by Monday at 5 pm PST will appear in your account on Tuesday, the following day)

- Depending on your bank institution, that account’s financial institution will complete the transaction according to its standard processing times. This may take between 1-3 days based on the financial institution, and will not deposit on weekends or holidays

- Transactions that are accepted and approved on weekends (Saturday and Sunday) and holidays will be deposited on the next available business day (Monday for weekend deposits, or if Monday is a holiday, Tuesday instead)

- Any transactions accepted and approved after the 5 pm PST cutoff time will be included in the next day’s deposit instead

FAQs

Where can I find out if a payment has been sent to my WePay account or to my bank?

You can track your payment details inside your FreshBooks account with the Payments in Transit widget here, or in the list of All Transactions here.

Payments can be tracked with the payment ID (an unique set of numbers that identifies a particular transaction) inside your WePay dashboard.

Where can I find CSV files or reports of my WePay transactions?

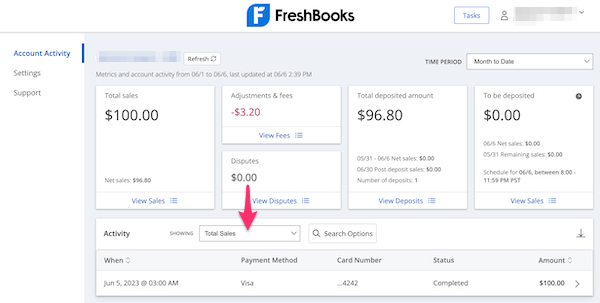

Inside your WePay dashboard, use these steps to download a specific CSV file of all activity or a specific type:

- Log into your WePay account

- While on the Account Activity tab, in the Activity section, select the dropdown next to Showing

![Dropdown to filter transactions by inside WePay account on Account Activity section.]()

- Choose Total Sales, All Activity, or Deposited Amount

- If needed, select Search Options button

- Then select the Please select a date range dropdown and choose between Today, Yesterday, Last 7 Days, Month to Date, or Custom

- Select Search

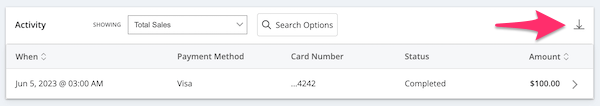

- Above the list of results in the top right corner, select the down arrow and a CSV file will begin downloading.

![Download button in top corner of list of transactions to download file.]()